PERA Financial Planning

Case Study

Project Duration: October 2023

Role: UX designer, UX researcher, UI designer from conception to delivery

Responsibilities: Conducting interviews, paper and digital wireframing, low and high-fidelity prototyping, conducting usability studies, accounting for accessibility, and iterating on designs.

The Goal

Design an app that provides a user-friendly and intuitive platform that empowers people to take control of their finances. We aim to help users easily track their income and expenses, set and achieve goals, and make informed financial decisions.

User Research

I conducted interviews and created empathy maps to understand the users I am designing for and their needs. A primary user group identified through research was young professionals. The secondary user group was people nearing retirement.

Pain Points

Time

Balancing a budget is stressful and time consuming

Personas

Problem Statement

James is a working professional who needs an app to help him budget because he is expecting his first child and wants to save for a home.

Competitive Audit

An audit on direct and indirect competitor products provided directions on gaps and opportunities to address with the PERA app.

I looked at Mint, YNAB and Pocket Guard.

Paper Wireframes

Taking the time to draft iterations of each screen of the app on paper ensured that the budget and dashboard features that made it to digital wireframes would address user pain points.

Digital Wireframes

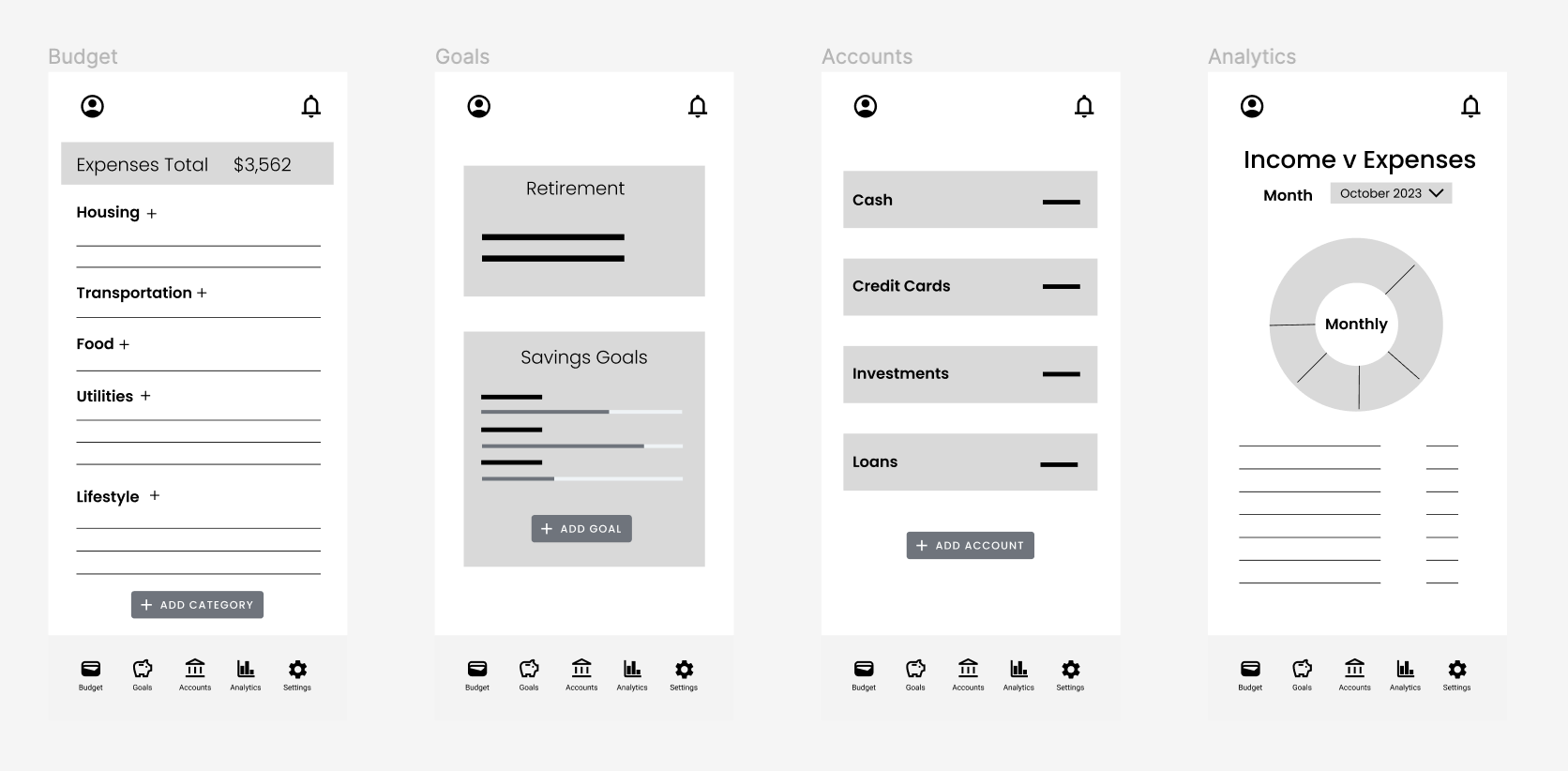

As the initial design phase continued, I made sure to base screen designs on feedback and findings from the user research. The digital wireframes focus on delivering personalized goals and budget.

Colours comply with WAI

Low Fidelity Prototype

To prepare for usability testing I created a low-fidelity prototype that connected the user flow of adding new items to the budget.

High-Fidelity Prototype

The high-fidelity prototype followed the same user flow and expanded upon it, also including the changes from the usability study.

Accessibility considerations

What I learned

I learned that even thought the problem I was trying to solve is complex and every person has different habits, usability studies can help find ways to design inclusively.

The Product

PERA is your companion in the world of personal finance. It's designed to help individuals gain control over their financial lives. The target users are young professionals, families and

retirees.

Too much information

Confusing data overload

Dashboard

Users want to see totals and summations with ease.

Accessibility

Handling your finances alone requires many apps

Problem Statement

Linda is a teacher nearing retirement who needs a user friendly financial planning app because she is handling her finances alone.

Visual Design

Usability Study Parameters

Study type: Unmoderated usability study

Location: Canada, remote

Participants: 5 participants

Length: 30-60 minutes

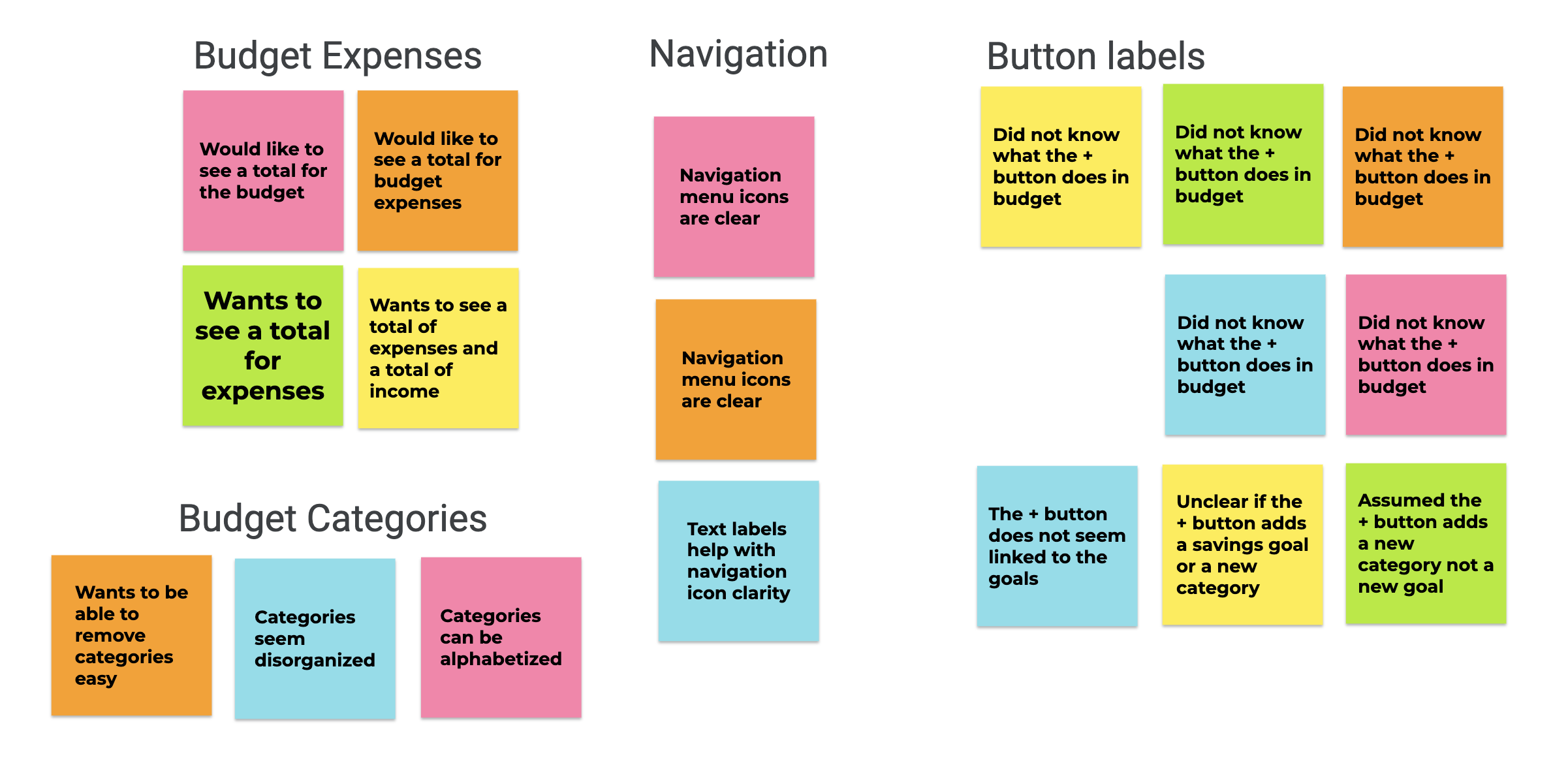

Usability Study Findings

Navigation

Users want clear button labels

Iterations based on the Usability Study

Based on insights from the usability study I added labels to the buttons and created graphics to visualize the progress on each category.

Additional design changes included adding an easy way to see all categories and sort them. A text field was also added to improve personalization.

Clear labels on interactive elements that can be read by screen readers.

Responsive Website

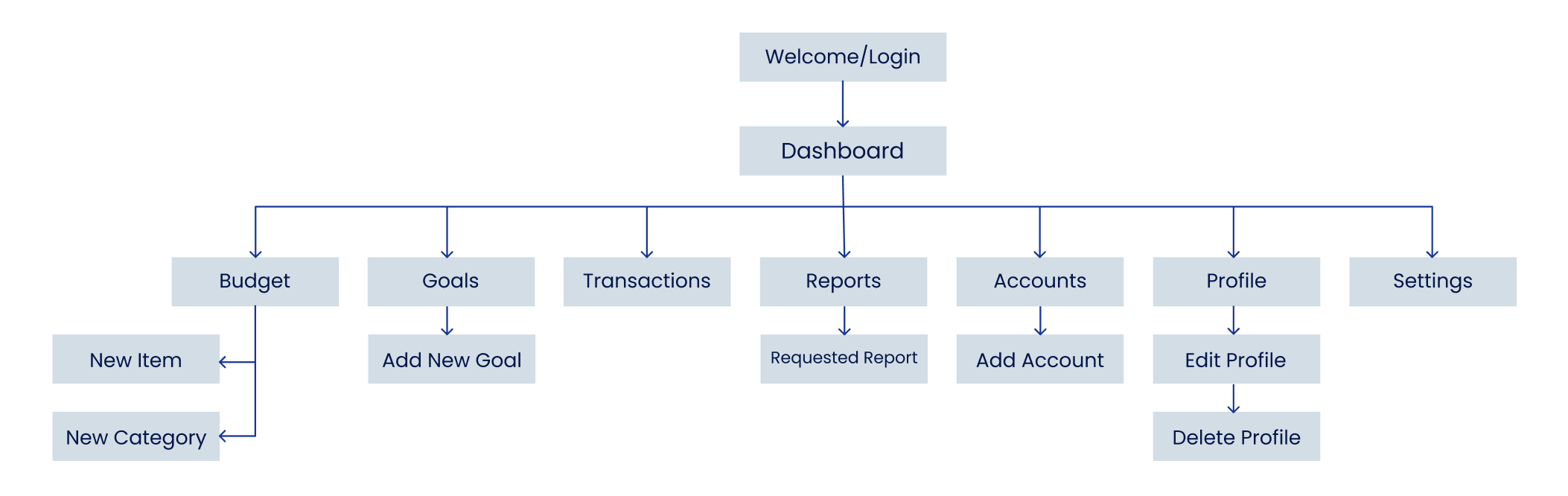

The responsive website information architecture ensures a cohesive and consistent experience across devices by using a dashboard navigation.

Each design is optimized to meet the user’s needs on different screen sizes including desktop, tablet and mobile devices.

Budget

Users want an easy way to add and remove categories

Impact

Users reported that the app facilitated budgeting. The visualizations ensure the experience is stress free and accommodates all levels of financial literacy.

Navigation includes icons and labels. Selected items are indicated by colour and graphic change.

Next Steps

Conduct research to find out how successful the app is in reaching its goal to facilitate financial planning

Add more resources to help educate the user about financial planning

The Problem

Many people struggle with disorganized finances, making it challenging to track their spending, save effectively, and plan for their financial future. This lack of financial clarity often leads to stress, missed opportunities, and a sense of being overwhelmed.